China’s Economy, Structural Changes and the New Geoeconomic Landscape

note

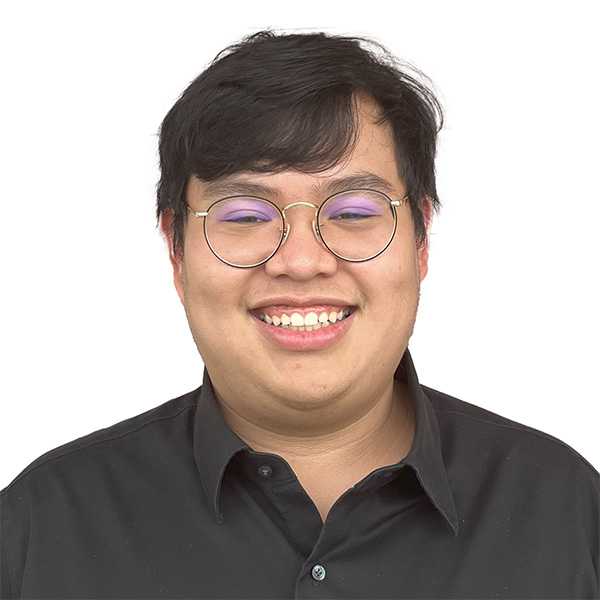

On Friday, June 20th, 2025, Professor Justin Yifu Lin delivered a lecture titled “China’s Economy, Structural Changes and the New Geoeconomic Landscape” at the second Academic Network Forum at the Bank of Thailand’s Northern Regional Office in Chiang Mai. Professor Lin is the Dean of the Institute of New Structural Economics at Peking University. He also served as Chief Economist at the World Bank from 2008-2012. This blog highlights some of the main points of his lecture and does not necessarily reflect the views of the authors, Bank of Thailand, or PIER.

Following major economic reforms starting in the late 1970s, China experienced the fastest sustained economic growth in history. In 1978, China’s GDP per capita was just $156, less than one-third of Thailand’s figure. Since then, its GDP per capita has grown nearly 50 times, making China the world’s second-largest economy in terms of nominal GDP. Moreover, while the Chinese economy represented only 4% of the global GDP in 2000, it has grown significantly to 16% by 2018. This rapid expansion is a testament to China's "great transformation."

In addition to rapid growth, the Chinese economy has proved resilient in times of economic crises. While many countries in the region were severely impacted during the Asian Financial Crisis of 1997-98, the Chinese economy remained relatively stable. When the global financial crisis hit in 2008, China still managed to maintain an average GDP growth rate of 9.4% during the seven years following this, which also benefited countries like Thailand, for whom China has become the number one trading partner.

Changes in the economic weight of great powers have historically defined global dynamics. In the early 2000s, a group of eight powerful countries (G8), i.e., the U.K., France, Germany, Italy, Russia, Japan, the U.S., and Canada, collectively contributed 47% of the world's GDP. However, in later years, this dynamic has changed dramatically. By 2018, the G8’s share of global GDP dropped below 35%, while China's share of global GDP rose from 7% to 17%, meaning that around 10 out of the 12 percentage points decline in the G8’s share was due to China's rise.

Professor Lin suggests that certain U.S. foreign policies have historically responded to the rise of foreign economies that could challenge its global economic position. He cites U.S. policies toward Japan in the 1980s, such as efforts to limit Japanese car exports, as an example. Recent tariffs on Chinese exports under Presidents Trump and Biden bear similarities to those earlier measures. Furthermore, the U.S. military presence in East Asia, expanded during President Obama’s administration following China’s rapid economic growth since 2000, could be viewed as part of a broader strategic response to China's rise.

Against this backdrop, Professor Lin argues that China does not want to “accept [such] constraints” which might result in a growth rate similar to Japan’s 1% annual growth in the 1990s, furthering that such a situation is “not acceptable to China” and “should not be acceptable to [Thailand]” due to the two countries’ close trade relationship.

Although many critics fear that the current economic tension between the U.S. and China will continue, Professor Lin believes the conflict will resolve as China grows and gains more leverage. If China’s per capita GDP were to reach just half of that of the U.S., its total economic size would double that of the U.S., given that China’s population is four times larger — a demographic reality that is unlikely to change in the next half century. Even China’s five coastal provinces, plus Beijing, Tianjin, and Shanghai, alone, already house 400 million people — more than the entire U.S. population — and these regions could eventually match the U.S. in per capita income and industrial capacity. With this scale and economic potential, the U.S. would struggle to dominate the global economy; on the other hand, U.S. companies may benefit from the large consumer base in China.

Furthermore, international trade, such as that of the U.S. and China, is generally mutually beneficial — especially for small economies due to access to larger markets and greater varieties of goods and services. The U.S. has, in the past, gained substantially from trade with China, especially through lower production costs. Therefore, a mutually beneficial trade relationship with China remains in the interest of both nations and the global economy.

Structural transformation has played an important role in helping China deal with multiple challenges, avoid economic crises, and maintain sustained growth in the past. While every year there has been the assertion that China has already reached its peak, Professor Lin believes the country still possesses significant potential for sustained growth through technology, innovation and industrial upgrading, as emphasized in the “New Structural Economics” model (NSE).

Structural transformation is very important for continued growth. Using Thailand as an example, Professor Lin suggested that a structural change in Thailand’s largest sector, agriculture, through increased use of technology, could boost its growth. Similarly, China must continue its industrial upgrading through domestic invention, technology licensing, and targeted importation of advanced technologies to maintain its competitive advantage. Citing the successes of Germany, Korea, and Japan during their periods of rapid industrialization, China has a potential growth rate of 8% annually from 2019-2035.

Last, China currently enjoys several comparative advantages that could be vital in continuing an over 8% annual growth rate going forward. The most important determinant of post-industrial revolution growth is human capital. China is poised to innovate more rapidly, with 6 million annual college graduates in STEM — twice the number of all the G8 countries combined. China’s vast domestic market, which is three times the size of the U.S. market, is also key to promoting the rapid scaling of new technologies and industries across the country. Furthermore, China offers a comprehensive and efficient manufacturing ecosystem and supply chains to foster technology advancements.

Professor Lin concluded his remark by saying that while challenges and friction between China and other nations, particularly the U.S., remain, China's economic growth is likely to continue and become a key driver of global demand and prosperity. After all, a cooperative relationship between China and the U.S. is the most critical for global and regional peace.