Measuring the Inflation Impact Across Two Successive U.S. Tariff Rounds

note

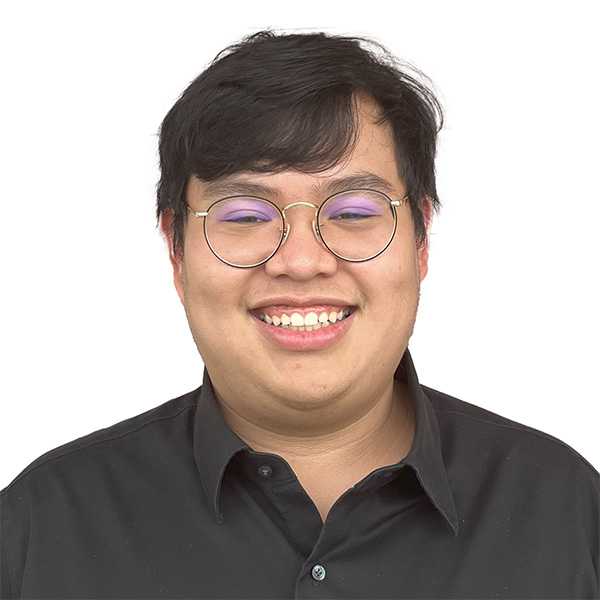

On Thursday, June 26th, 2025, Professor Alberto Cavallo of Harvard Business School gave the talk, “Tariffs and U.S. Inflation” at the Bank of Thailand. His recent lecture sheds light on the evolving landscape of U.S. inflation and the direct and indirect effects of new tariff policies. Professor Cavallo of Harvard Business School is a leading voice in understanding contemporary inflation dynamics, particularly the nuanced impact of trade policies like tariffs. He is also the co-founder of PriceStats, a platform that collects daily online price data, and serves as Academic Partner of State Street Associates, a global financial services firm and custodian bank with a focus on strong investment research. This article reports some of the main points of Cavallo’s lecture and does not necessarily reflect the views of the authors, Bank of Thailand, or PIER.

Cavallo's analysis begins with the current state of U.S. inflation, observed through PriceStats data. He notes that while overall inflation has remained consistent since December 2024, it is not at a level that raises significant concern. However, a deeper dive into sectoral data reveals important divergences. Specifically, in May 2025, following recent tariff announcements, sectors heavily reliant on Chinese imports, such as household equipment and electronics, exhibited inflation rates considerably higher than their 10-year averages. In contrast, the transportation sector, including fuel prices, has shown a much lower inflation rate over the same period, currently acting as a moderating force on overall price increases.

A significant portion of Cavallo's work draws lessons from the first U.S.-China trade war (2018-2019), detailed in his 2021 paper "Tariff Pass-Through at the U.S. Border and at the Store." This research sought to answer a fundamental question: who ultimately pays for the tariffs? Cavallo describes several of his 2021 paper’s key findings, explaining why much of the cost of the tariffs was borne by the U.S. despite pass-through to consumers often being limited.

First, contrary to the Trump administration's assertion that Chinese exporters would bear the cost, Cavallo's findings indicated that U.S. importers absorbed the majority of the tariff burden. A 20% tariff was associated with a 18.4% higher post-tariff price faced by the U.S. importer. Chinese exporters, meanwhile, largely maintained their prices, possibly due to already-thin margins or the relatively inelastic demand for their goods in the U.S., which faced limited alternative sourcing options.

However, the full post-tariff pass-through of prices to the U.S. importer at the border did not always translate to higher prices in the store. Cavallo finds that for a tariff to lead to significant retail price adjustment, it often needs to be large or highly visible to the consumer. While washing machines, hit by highly publicized tariffs at the very beginning of the first U.S.-China trade war, saw significantly higher retail prices in the U.S., Cavallo explains that goods affected by similarly-sized but lesser-known tariffs did not experience this same adjustment, possibly due to fear of alienating consumers unaware of the tariff. Larger tariffs were also more likely to trigger retail price adjustments, as 20% tariffs caused significant reactions while 10% tariffs often had minute effects.

Second, U.S. firms engaged in "front-loading" inventories, or importing goods earlier than planned, before tariffs came into effect, absorbing costs as they expected the tariffs to be temporary. U.S. firms also participated in trade diversion, resulting in the share of Chinese imports decreasing from 90% to 70%. These collective responses contributed to the limited pass-through of costs to U.S. consumers during that period.

Third, U.S. exporters faced the brunt of the cost of retaliatory tariffs, lowering prices at the border by about 7% in response to tariff rates that averaged 15%.

Looking at the current round of tariffs (2025), Cavallo predicts a different outcome, with a potentially higher and faster pass-through of costs to consumers. Several factors contribute to this shift in dynamics. Firstly, firms' expectations regarding the permanence of tariffs have changed; unlike the initial trade war, there's now a greater belief that these measures will persist, owing in part to the continuation of many of Trump’s first tariffs by the Biden administration. Secondly, the post-pandemic environment has fostered a more flexible price-setting environment, where firms are more accustomed and willing to adjust prices frequently in response to cost pressures. Lastly, the magnitude of the current tariffs are much larger than the previous round of tariffs which could make the importers unable to absorb the price changes. The current retaliation tax on Chinese goods reached its peak at 125% while the first round of tariffs was below 10% in President Trump’s first administration and rose to 20% under President Biden. Cavallo's ongoing research, which tracks price data from large U.S. retailers, shows rapid but modest price jumps in imported goods directly affected by the tariffs.

Furthermore, rising prices for goods affected by tariffs appear to have spillover effects, raising prices even of domestic goods that are not directly targeted by tariffs. This suggests broader cost pressures or increased pricing power for domestic firms. Analysis by country of origin further illustrates this, with prices of goods from China showing distinct increases, while those from Canada and Mexico have remained relatively stable, likely due to market expectations of the U.S. primarily targeting China or potential trade agreements with Canada and Mexico.

Despite these localized impacts, Cavallo emphasizes that the overall effect of tariffs on aggregate inflation is likely to remain relatively small unless combined with other significant economic shocks, such as an energy price surge. Such external shocks could provide firms with a broader justification to pass on accumulated costs. Furthermore, while "shrinkflation" (lowering product quantity) has gained media attention, Cavallo's research has not found it to be a widespread phenomenon. Instead, he highlights "cheapflation"—the faster rise in prices of cheaper varieties of goods as consumers shift their demand towards more affordable options during inflationary periods—as a more notable trend.

Ultimately, Cavallo's insights suggest that the Federal Reserve may not need to be overly concerned about tariff-driven inflation in the short term, potentially creating room for future interest rate adjustments, though persistent uncertainty remains a crucial consideration for policymakers. For more information, readers are advised to refer to Cavallo’s working paper, “Tracking the Short-Run Price Impact of U.S. Tariffs”.