Macroeconomic Effects of Macro-prudential Regulation in Asian Economies

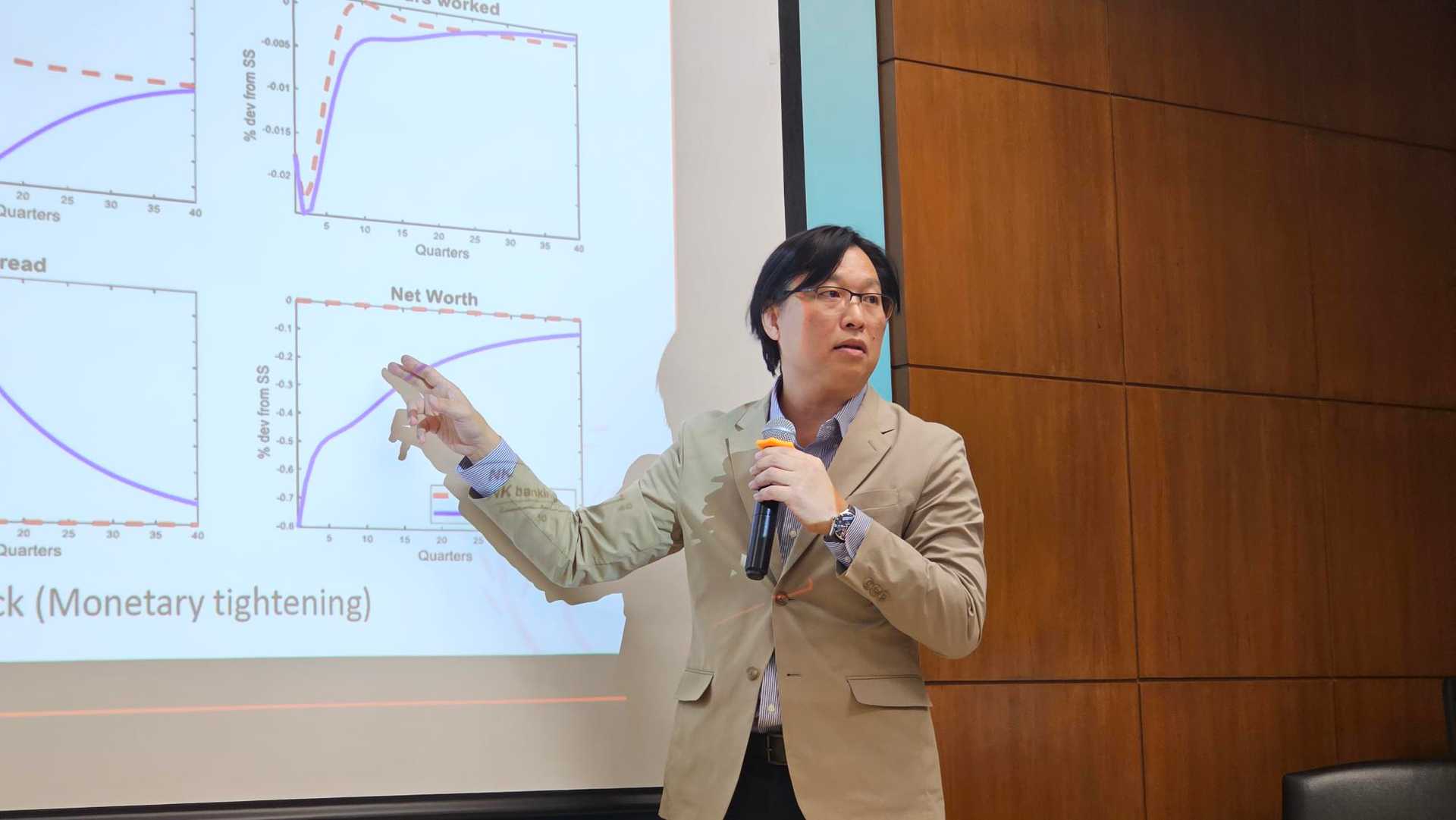

Associate Professor Nipit Wongpunya from the Faculty of Economics, Chulalongkorn University, presents a New Keynesian DSGE model with an integrated banking sector. The study investigates how macro-prudential regulation (MPR) can enhance financial stability and improve the effectiveness of monetary policy in Asian economies.

This paper examines the role of macro-prudential regulation (MPR) in enhancing financial stability and improving the effectiveness of monetary policy in Asian economies. We develop a New Keynesian DSGE model with an integrated banking sector featuring endogenous leverage, credit spreads, and capital quality shocks. Using Bayesian estimation and quarterly data for Thailand, China, Indonesia, and South Korea from 2001Q1 to 2019Q4, we estimate country-specific Taylor-type monetary rules and leverage-based MPR rules. Results indicate that MPR, designed to be countercyclical with output but procyclical with spreads, stabilizes credit during downturns and restrains leverage in booms. MPR produces very different policy stances across shocks. Model comparison shows that combining a Taylor rule with MPR provides a better fit than conventional monetary policy alone. Welfare analysis shows that optimal response of MPR is not symmetric to monetary policy. A strong MPR is optimal under monetary tightening whereas a moderate MPR is optimal under monetary loosening. Policy effectiveness, however, varies across countries: Thailand and South Korea display strong inflation targeting and balanced MPR; China emphasizes output stabilization with weaker MPR; Indonesia pursues aggressive monetary policy with slow leverage adjustment.