In Search of Thailand’s Economic Destiny: Creative Destruction and Capital Misallocation

excerpt

The ongoing slowdown in Thailand’s economic growth has raised concerns about long-term growth prospects. How can Thailand maintain a solid growth rate and transition to high-income status? This aBRIDGEd reviews selected empirical research on Thailand’s long-term growth prospects through the lens of Schumpeterian growth or creative destruction theory, suggests avenues for future research and discusses policy implications. It finds that there is evidence of creative destruction at work in the Thai economy but it remains impeded by structural constraints. Moving forward requires a fundamental rethink of Thailand’s deep drivers of growth.

All nations aspire to lasting economic prosperity. Yet only a handful of emerging markets have made the transition into advanced economies. Some try, fail and fall behind. Fortune can be fickle. Thailand’s fate, it would seem, is in limbo. The ongoing slowdown in Thailand’s economic growth has raised concerns about Thailand’s long-term growth prospects. Since the 1980s, Thailand’s economic reforms and trade openness have put the economy on a high growth trajectory. The economy grew around nine percent over 1986–1995. After remaining a leading emerging market for several decades, the growth trajectory is slowing. In the past five years, Thailand’s trend growth has slowed to less than four percent. Total factor productivity growth has also slowed. Private investment as a share of GDP remains below pre-1997 levels.

What are Thailand’s long-term growth prospects? How can Thailand sustain its long-term growth rate? Can it reach advanced economy status? Economic theory tells us that long-run growth must ultimately come from productivity gains as returns from capital expansion and labor accumulation inevitably diminish. Thailand is at a juncture where this insight is particularly relevant. Past productivity gains were realized by the large reallocation of labor from the low productivity agricultural sector to the high productivity manufacturing sector and accounted for more than half of labor productivity growth in 1986–1996 (Ariyapruchya, Chantapant, and Apaitan 2011). However, what got Thailand here will not apply going forward. Large-scale inter-sectoral reallocation and the associated productivity gains witnessed in the past are unlikely to repeat. Furthermore, the returns to investment will eventually diminish and labor force expansion faces headwinds from an aging society.

Understanding Thailand’s long-term growth prospects going forward entails rethinking the deep drivers of growth. Drivers of growth do not refer merely to growth accounting or the expansion of production of goods and services in sunrise industries, or increases in consumption, investment, fiscal spending or exports that constitute macroeconomic demand. Rather, drivers of growth refer to underlying mechanisms that allows the economy to constantly find new ways to produce more with less. One such mechanism in the economics literature on long-term growth is creative destruction. It is particularly relevant to Thailand at this juncture because it focuses on explaining how the economy can sustain long-term growth through productivity gains and efficient allocation of resources.

There is substantial international evidence that creative destruction, the never-ending process by which product and process innovation bring about the rise of new firms and the fall of old firms and industries, drives long-term economic growth. The majority of empirical research has focused on factor reallocation, in particular labor flows and job creation, as a proxy of creative destruction. Job creation and destruction flows tend to be large and persistent and take place within as opposed to between narrowly defined sectors of the economy, suggesting that innovation often takes place at the narrow sectoral level. Davis, Haltiwanger and Schuh (1996) report such findings for the US economy. Foster, Haltiwanger and Krizan (2001) find that labor reallocation between plants accounts for half of manufacturing productivity growth. Bartelsman, Haltwanger and Scarpetta (2004) reports similar evidence in 24 countries. Caballero, Cowan and Micco (2004) finds that labor regulation and protection can hamper creative destruction process based on a panel data of 60 countries.

Amarase, Apaitan and Ariyapruchya (2013) find some evidence of creative destruction in Thailand. First, flows of capital associated with factor reallocation from low productivity firms to high productivity firms occur in narrowly defined sectors, particularly in electronics or those with high export shares. As a result, aggregate productivity growth is boosted. Second, new firms undergo a selection process whereby innovative firms survive, grow in size and become industry leaders. However, protected or less competitive sectors show less flows of capital as well as less firm entry and exit. The forces of creative destruction are not prevalent throughout all sectors, suggesting that the economy is bifurcated (see here).

Competition, both domestic and international, can be an important force for creative destruction. Competition lowers firm profit margins and incentivizes firms to innovate to survive. New entrants can also learn from or imitate incumbent firms that have innovated ahead. Ariyapruchya, O-lanthansate and Karnchanasai (2006) finds that firm productivity is highest when firms face goods markets competition, as proxied by firm rents, industry concentration, ease of entry and exit, and export share. Klapper, Laeven and Rajan (2004) find that stringent barriers to entry inhibit industry growth in European data.

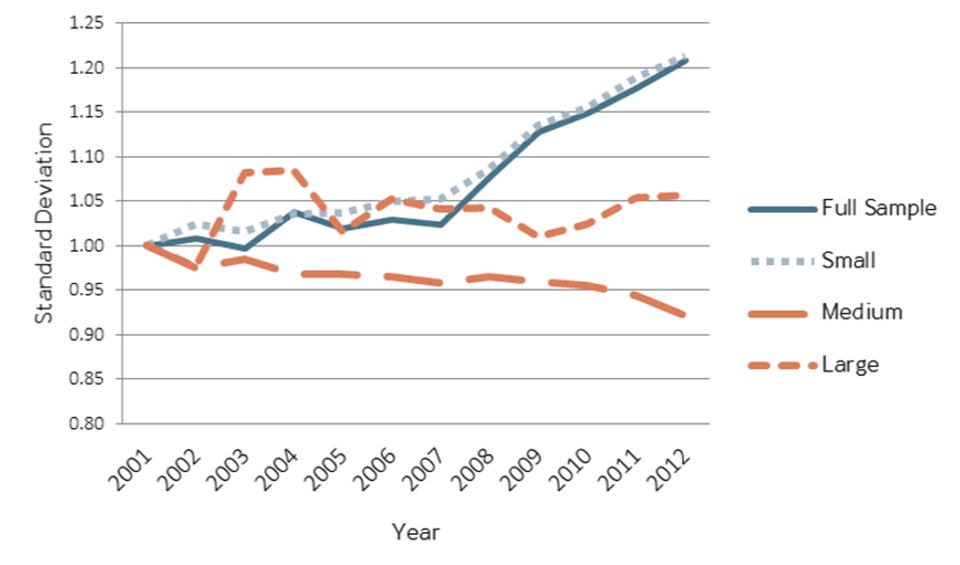

Note: A Small firm is defined as having a book value of fixed capital below 50 million baht,a medium firm a book value of fixed capital of 50–200 million baht and a large firm a book value of fixed capital above 200 million baht (following the Ministry of Industry’s classifications).

Research on the efficiency of physical capital allocation can also be interpreted by creative destruction theory. Well-functioning markets should allocate capital so that the marginal revenue product of capital (MRPK) is equated by the market interest rate. In addition, the dispersion of MRPK should be small. That is, capital should flow from low productivity to high productivity firms until returns to capital are broadly aligned. In reality, this is not the case. Certain firms have high MRPK but for some reason are not able to obtain resources to expand. Conversely, certain firms with low marginal product of capital have too much capital. Hsieh and Klenow (2009) and Gopinath et al (2015) find considerable variation in the distribution of MRPK across a wide range of countries. Ariyapruchya, Chantapant and Apaitan (2011) finds that Thailand’s capital allocation is less efficient compared to developed economies, although more efficient than developing economies.

Following Gopinath, we measure MRPK as operating profit over fixed assets using firm data of approximately 300,000 firms across all industries and find that capital misallocation has worsened over 2001–2012 (see Figure 1). The standard deviation of log MRPK of firms in each size category (i.e. small, medium and large) is calculated. The total is calculated using the capital share of each size category as weights. Small firms show noticeable increase in capital allocation inefficiency while medium and large firms improve after 2001 but then levels off.

Paweenawat (2015) examines data from Thailand’s manufacturing industry census in 1997 and 2007 finds that Thailand’s capital allocation is inefficient compared to China, India and the U.S. If Thailand were to increase its allocative efficiency to the U.S. level in 1997, aggregate productivity level would increase between 70–80 percent. Inefficient capital allocation suggests that the Thai economy’s underlying driver of growth faces structural constraints that are preventing it from reaching its long-run potential. In addition, the fact that certain firms exhibit high MRPK in excess of the cost of financing reflects that underlying investment potential does indeed exist. Harnessing creative destruction could therefore fix the apparent puzzle of moribund private investment in Thailand.

There is growing empirical evidence that creative destruction is an important growth mechanism. In the case of Thailand, there is some evidence that the forces of creative destruction are at work. However, it is not prevalent, suggesting that the economy is bifurcated: a dynamic Thailand co-exists alongside a stagnant Thailand. The challenge for further research is to identify the sources of the structural impediments for factor reallocation, both capital and labor. Structural impediments could arise from, for example, uncompetitive goods markets, price distortions such price controls, subsides or the minimum wage, corruption, labor skills mismatch, lack of physical infrastructure or credit constraints. Labor flows as a proxy of creative destruction remains relatively understudied.

Thailand’s total factor productivity stands at about 44 percent of the U.S. level (Penn World Tables). There is still considerable room for Thailand to grow by productivity upgrading to catch up with the world technology frontier. To do so, policymakers must implement reforms and coordinate policies across diverse areas such as competition policy, education, labor market, capital market and the institutional environment concerning, for example, intellectual property rights.

Aghion, P. and Howitt, P. (1998). Endogenous Growth Theory. Cambridge, MA: MIT Press.

Amarase, Nakarin, Tosapol Apaitan, Kiatipong Ariyapruchya (2013). Thailand’s Quest for Economic Growth: From Factor Accumulation to Creative Destruction. Bank of Thailand Working Paper.

Ariyapruchya, Kiatipong, Cheerapan O-lanthanasate, and Chatsurang Karnchansai (2006). Strengthening the Competitiveness of Thai Firms: What Needs to be Done? Bank of Thailand Working Paper.

Ariyarpuchya, Kiaitpong, Sukonpat Chantapant, Tosapol Apaitan (2011). Dealing with Structural Change: a Diagnosis of the Thai Economy. Bank of Thailand Working Paper.

Bartelsman, E., Haltiwanger, J. and Scarpetta. S (2004). Microeconomic evidence of creative destruction in industrial and developing countries. Mimeo, University of Maryland.

Caballero, R., Cowan, K., Engel, E., and Micco, A. (2004). Effective labor regulation and microeconomic flexibility. Mimeo, MIT.

Davis, S., Haltiwanger, J. and Schuh, S. (1996) Job Creation and Destruction. Cambridge, MA: MIT Press.

Feenstra, Robert C., Robert Inklaar, and Marcel P. Timmer (2015). The Next Generation of the Penn World Table. American Economic Review (forthcoming).

Foster, L., Haltiwanger, J. and Krizan, C (2001). Aggregate productivity growth: lessons from microeconomic evidence. In New Developments in Productivity Analysis, ed. E. Dean, M. Harper and C. Hulten. Chicago: University of Chicago Press.

Gopinath, Gita, et al. (2015) Capital Allocation and Productivity in South Europe. NBER Working Paper Series, No. w21453.

Hsieh, Chang-Tai, and Peter J. Klenow. (2009). Misallocation and Manufacturing TFP in China and India. Quarterly Journal of Economics, 124(4): 1403–1448.

Paweenawat, Archawa (2015). Resource allocation and productive efficiency in Thailand’s manufacturing sector (ปัญหาการจัดสรรทรัพยากรที่ไม่เหมาะสมและผลิตภาพของปัจจัยการผลิตโดยรวมของภาคอุตสาหกรรมการผลิตของไทย) Thailand Research Fund Working Paper.